Sage 300: Setting Up a New Bank

Switching banks or opening a new account at an existing bank are common activities in the treasury area. With any of these scenarios you will need to set up a new Bank in Sage 300. Follow along as we review the related steps.

Setting up a new bank account in Sage 300 is a routine yet crucial task for organizations managing their treasury operations. Whether you’re switching banks or opening an additional account, understanding the steps for a seamless Sage 300 bank setup ensures your financial processes remain accurate and efficient.

This article will guide you through the essential stages of Sage 300 bank setup, from completing the Bank Profile and configuring GL accounts to managing check stock and multicurrency options-all designed to help you maintain control and flexibility in your financial management.

What is Sage 300?

Sage 300 is a comprehensive enterprise resource planning (ERP) solution designed for small to medium-sized businesses looking to manage their finances, operations, and inventory efficiently. Trusted by over 40,000 customers in more than 150 countries, Sage 300 offers robust modules for financial management, inventory control, sales, project management, and more-all within a centralized, multi-currency, and multi-language platform. Its flexibility allows businesses to streamline processes, automate transactions, and gain real-time insights, making it ideal for companies with multiple entities or locations seeking scalable growth and operational efficiency.

Sage 300 Bank Setup: Streamlining Your Financial Management

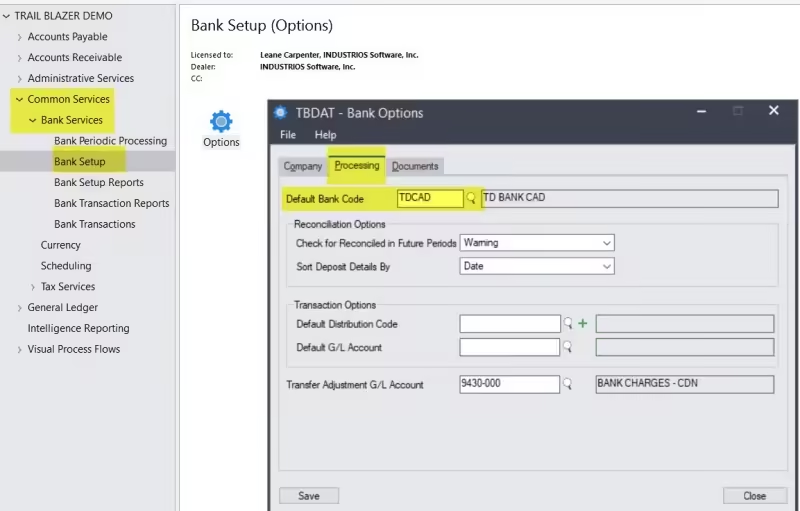

You will find the Bank menu option under Common Services> Bank Services.

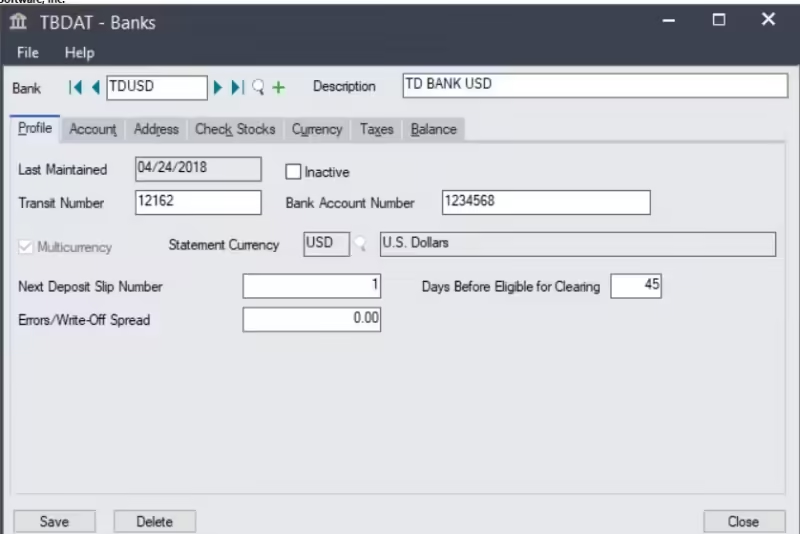

The first step is to complete the Bank Profile. This will allow you to specify things such as your next Deposit Slip Number, Account Number and Write-Off Spread.

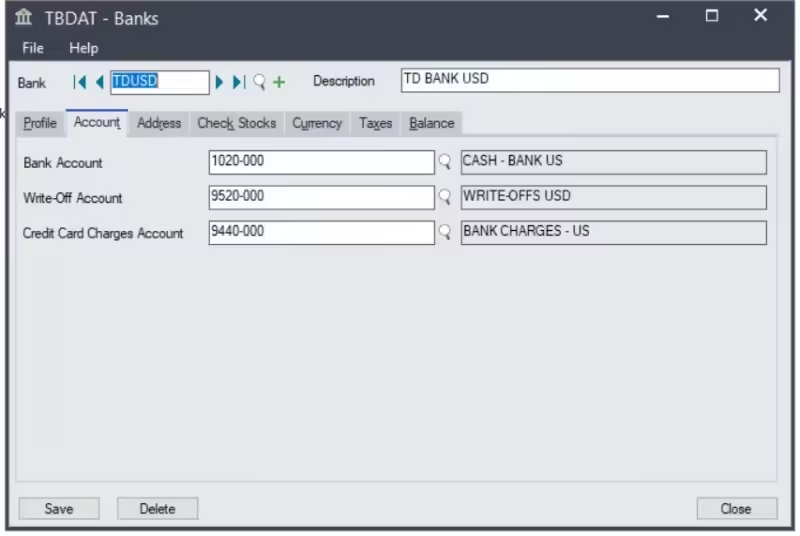

Next up is the Account Tab. Use this tab to select the GL accounts to be used for the Bank Account, Write-Offs and Credit Card Charges.

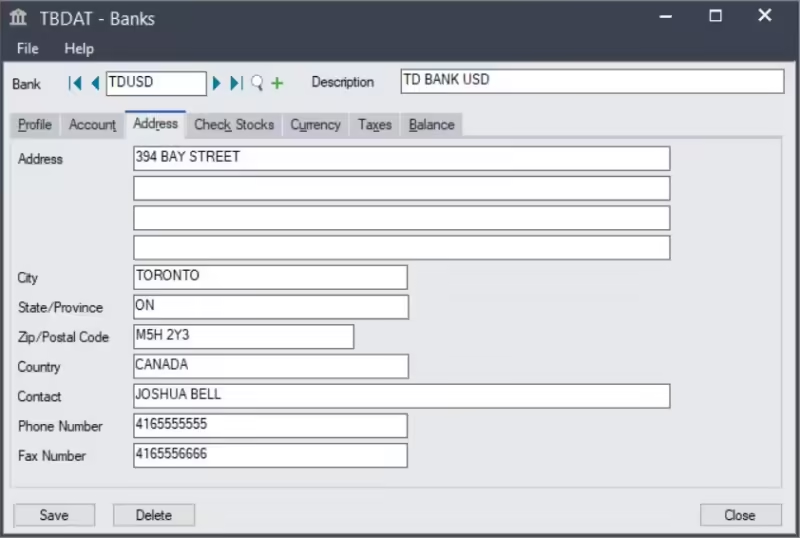

Enter the bank’s address (up to 60 characters), telephone and fax numbers (up to 30 characters each), and contact person (up to 60 characters).

This information can be modified after saving, if necessary.

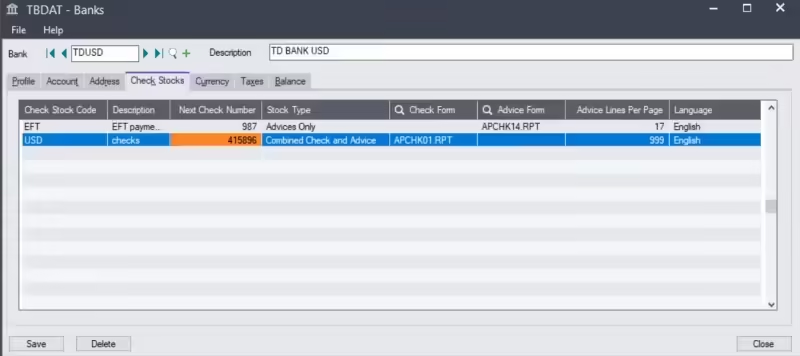

Use the Check Stock Tab to enter printing information for checks drawn on the bank account.

For each physical check stock that you use with this account, you must:

- Enter a code and the next number to assign to checks drawn on this account.

- Select the type of stock (combined, sequential, or separate checks and advices).

- Select the report specifications for the check and advice forms you use.

- Select the language that you want to appear on the body of the check.

You can change the information on this tab after saving the bank record.

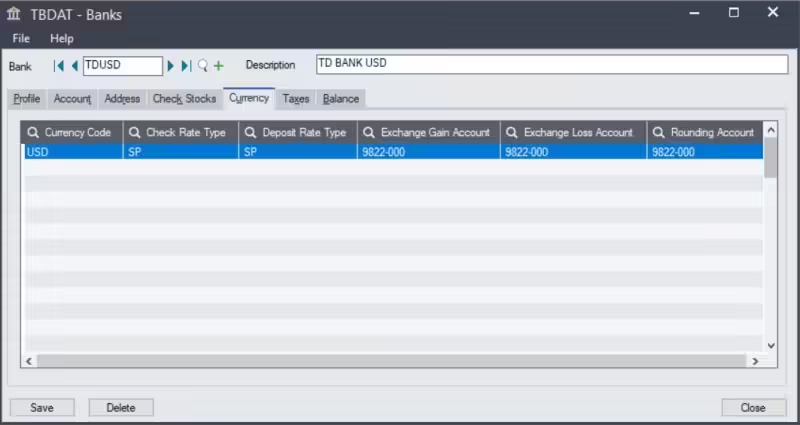

The Currency Tab appears only if the Multicurrency option has been selected on the Profile tab.

Use this tab to enter currency information for multicurrency and foreign currency banks.

Note: Must be a multicurrency company for this option

For each currency you use with this bank account, you must enter:

- The default check and deposit rate types.

- The General Ledger accounts to which realized gains or losses in currency exchange are posted.

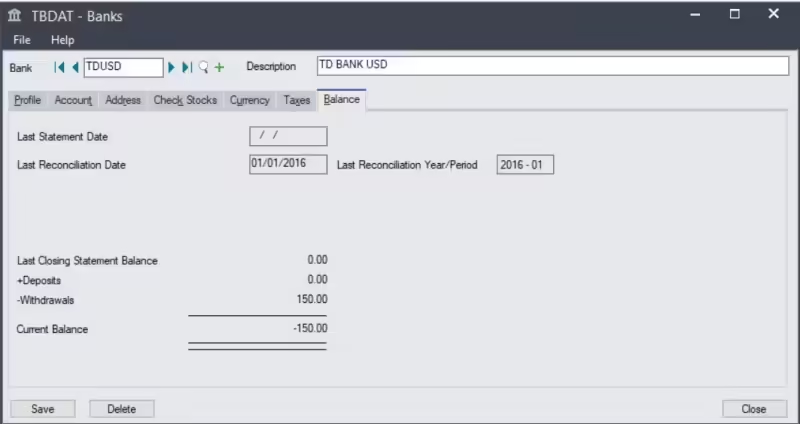

The Balance Tab displays up-to-date information for a bank account, including:

- The last statement date, the last reconciliation date, and the year and period to which the reconciliation was posted.

- The closing balance of the last bank statement to which the account was reconciled.

- The total of all deposits outstanding

- A total of all withdrawals

- The current balance

If this bank is to be your Default Bank go into Bank Setup> processing tab and select the default bank code as shown below.

Final Thoughts on Sage 300 Bank Setup

A well-executed Sage 300 bank setup lays the foundation for accurate financial tracking and streamlined treasury operations. Taking the time to properly configure your bank profiles, assign the correct GL accounts, and set up check printing and multicurrency options will help prevent errors and save valuable time in your daily accounting processes. With Sage 300 bank setup, you can ensure that your organization’s banking information is always up to date, secure, and easily accessible for audits or financial reviews. Ultimately, investing attention in your Sage 300 bank setup not only supports compliance and internal controls but also empowers your business to respond quickly to changes and make informed financial decisions.